A New Option for Providing Health Coverage in 2020

Under new rules released by the Departments of Labor, Health and Human Services, and the Treasury, employers can offer a health reimbursement arrangement (HRA) instead of a traditional group health plan starting in January 2020. With an Individual Coverage HRA, an employer contributes funds to special accounts that employees can use to choose their own health insurance.

An Individual Coverage HRA that provides sufficient funding can satisfy the employer mandate put in place by the Affordable Care Act (ACA). Employers with 50 or more full-time employees are still required to offer affordable health coverage that meets certain minimum standards or pay a penalty to the IRS.

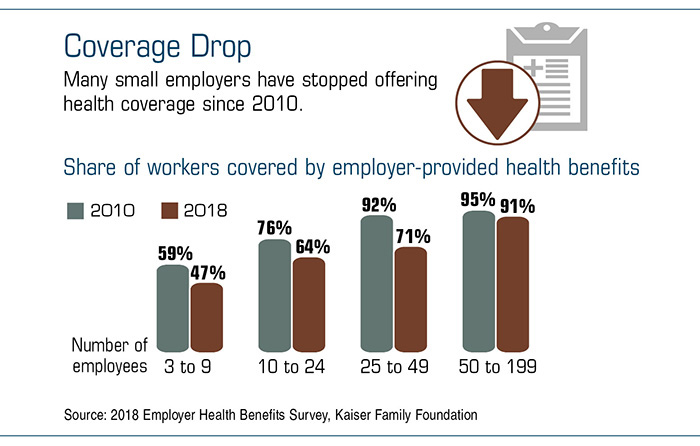

This type of HRA is largely intended to help small businesses that would like to offer health coverage but often struggle to do so, partly due to high administrative costs.

When all is said and done, roughly 800,000 employers are expected to take advantage of Individual Coverage HRAs to help pay for health insurance for more than 11 million people, about 800,000 of whom would be newly insured.1

How They Work

Companies can’t offer the same group of workers a choice between a traditional group health plan and an HRA — it’s one or the other. Employers may not push individual employees into HRAs, but an HRA could be offered on the same terms to all members of a certain class of employees, such as all hourly workers or all new hires, while a traditional health plan is offered to other classes. For an employer with fewer than 100 employees, a class must have a minimum of 10 employees.

Employer contributions to Individual Coverage HRAs are tax deductible for the company and tax-free for workers. Employees must enroll in individual health insurance (or Medicare) for each month they (or their dependents) are covered by the HRA. Employees can purchase coverage from a state-based exchange or the private market, but it must be an ACA-compliant plan.

One complication is that offering an Individual Coverage HRA may cause lower-paid workers to lose their eligibility for premium tax credits they might otherwise receive for individual insurance purchased on an exchange, whether they sign up for the company’s HRA or not.

Offering health benefits could help you compete for talent in today’s tight job market. If you are interested in offering an Individual Coverage HRA, make sure to review the rules, responsibilities, and conditions carefully.

1) U.S. Departments of Treasury, Labor, and Health and Human Services, 2019

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2019 Broadridge Investor Communication Solutions, Inc.share|

Ready to Take The Next Step?

For more information about any of our products and services, schedule a meeting today.