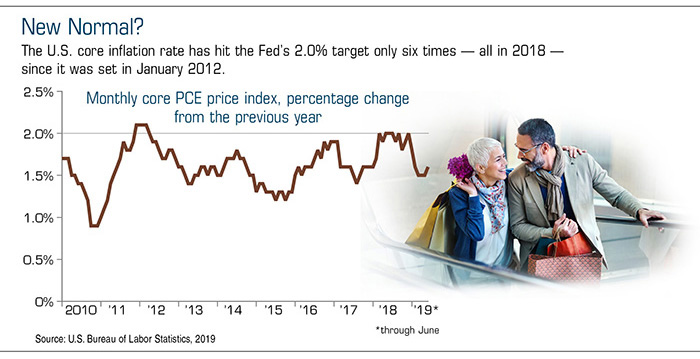

Prices and the Economy

The Federal Open Market Committee raises or lowers interest rates to help keep inflation near a 2% target, which is the rate believed to be consistent with the Federal Reserve’s dual mandate to seek stable prices and maximum employment. According to the personal consumption expenditures (PCE) price index — the Fed’s preferred inflation gauge — core prices (excluding food and energy) rose just 1.6% year-over-year in June 2019, even though the unemployment rate was sitting near 50-year lows (3.7%).1-2

In the past, tight labor markets have paved the way to higher wages and inflation. The last time unemployment was close to today’s levels (3.5% in late 1969), overall inflation was running closer to 6.0% and housing costs were rising even faster.3

Low inflation may seem like good news, especially for cash-strapped consumers and retirees living on fixed incomes, but it has a darker side. Wage gains have also been weaker than expected, and lack of pricing power is often a reflection of a soft economy. When demand is tepid and/or profits suffer, companies that can’t raise prices may eventually cut spending — including payrolls — instead.

Deflation Fears

Despite low interest rates, too-low inflation can discourage borrowing and spending and perpetuate economic weakness. Moreover, inflation below the target level elevates the potential risk that an environment of falling prices, or deflation, could follow an economic downturn.

When prices are falling, consumers often hold off on purchases because they expect to pay less later. Deflation can deteriorate into a prolonged spiral of falling prices, wages, and asset values. The last time the United States experienced serious deflation was in the 1930s during the Great Depression. However, Japan has been struggling with bouts of deflation for more than two decades.4

Inflation Fighters

A combination of structural changes in the U.S. economy and global market conditions are helping to drive down inflation.

Demographic trends. Retiring baby boomers are largely being replaced with a much smaller generation of entry-level workers. When young people earn enough money to strike out on their own, it typically spurs additional spending — on places to live, furniture and appliances, vehicles, and other products and services that are needed to set up new households. When people retire, they typically reduce their spending overall and focus more on preserving their savings.

If a larger, older population is spending less on products and services and the younger population is too small to drive up consumer spending, weaker overall demand could restrain gross domestic product (GDP) growth and inflation over the longer term.

Rise of e-commerce. Websites and mobile apps connect buyers to sellers regardless of proximity, increase the visible supply of available goods and services, and facilitate price comparisons so consumers can choose less-expensive options. As a result, more intense competition may be helping to hold down consumer prices.

Growth slowdown. An aging population and advanced technologies are changing how people work and spend, and these longer-term trends may continue to dampen inflation in the coming years. More recently, trade disruption and slowing U.S. and global economic activity have been causes for concern. According to mid-year projections, Fed officials expect U.S. GDP growth to slow from 3.0% in 2018 to around 2.1% in 2019.5

On a positive note, the absence of price pressures may enable the Fed to keep interest rates low for a longer time without sparking runaway inflation. But policymakers could be surprised by the path of inflation in the coming months. For this reason, it might be wise to have a financial strategy that takes a range of economic conditions into account.

1) U.S. Bureau of Economic Analysis, 2019

2) U.S. Bureau of Labor Statistics, 2019

3) Reuters, June 3, 2019

4) Council on Foreign Relations, 2018

5) Federal Reserve, 2019

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2019 Broadridge Investor Communication Solutions, Inc.

Ready to Take The Next Step?

For more information about any of our products and services, schedule a meeting today.