Retirement Savings: Traditional, Roth, or Both?

Choosing a traditional or Roth structure for your IRA or employer-sponsored retirement plan — such as a 401(k), 403(b), or 457(b) plan — is a key decision in your retirement saving and distribution strategies. While these distinctions are important at any age, they can be especially critical for older workers, who may be in their peak earning years while also facing retirement in the not-too-distant future.

Whether you already have a traditional account, a Roth account, or both, it’s still important to consider the benefits and downsides of each with an eye toward future contributions and possible Roth conversions.

Current-Year Tax Break vs. Tax-Free Income

While traditional contributions are generally tax deductible (or pre-tax for payroll deductions), Roth contributions are made with after-tax dollars. When it’s time to make withdrawals, however, the situation is reversed. You are subject to federal income taxes on withdrawals from a traditional IRA or employer account, including any accrued earnings. Withdrawals of Roth contributions are tax-free, and withdrawals of earnings are tax-free as long as they are “qualified” under IRS rules (see below).

The current-year tax benefit for contributions to a traditional IRA or employer plan is generally most valuable if you are in a higher tax bracket than you expect to be when you begin taking distributions. It may also be worthwhile even if you expect to be in the same bracket after you retire, because the current-year benefit may allow you to make higher contributions while staying within your budget. For someone in the 22% federal income tax bracket, each $1,000 contribution costs only $780 out of pocket after the tax deduction or pre-tax payroll deduction. Tax advantages for state income tax can make the “discount” even higher.

On the other hand, tax-free earnings in a Roth account could make Roth contributions more valuable in the long run compared with the current-year tax deduction for a traditional IRA. This makes Roth accounts more beneficial for younger investors who have a long time horizon in order for earnings to accumulate. But older investors may have a longer timeline than they realize. A 55-year-old who plans to retire at 65 may be tapping retirement savings for another 20 or 30 years after leaving the workforce, giving a Roth account decades of potential growth.

RMDs, Contributions, and Conversions

Traditional IRAs and employer-sponsored accounts are subject to required minimum distributions (RMDs) that must begin by April 1 of the year following the year in which you turn age 72 (or age 70½ if you were born before July 1, 1949). *You may be able to delay RMDs from your employer account if you are still employed by the company that sponsors the plan.

By contrast, there are no mandatory withdrawal requirements for Roth IRA owners. So you can keep assets in a Roth IRA as long as you wish. You must take RMDs from designated Roth employer accounts, but these can be avoided by transferring the funds to a Roth IRA. (Note that inherited retirement accounts must be liquidated within 10 years of the original owner’s death, unless the beneficiary is a surviving spouse or minor child, a disabled or chronically ill individual, or a beneficiary who is not more than 10 years younger than the original account owner; they are still allowed to take RMDs over their life expectancies. The 10-year rule takes effect when a minor child beneficiary reaches the age of majority.)

Tax-free distributions from a Roth IRA not only may keep you in a lower tax bracket but might avoid triggering taxes (or higher rates) on capital gains, net investment income, and Social Security income, and could avoid or reduce the Medicare surcharge. Even if you have substantial assets in a traditional IRA or an employer plan, it may be helpful to fund a Roth IRA, either by making contributions or by converting funds. When executing a Roth IRA conversion, you would owe income tax on the taxable portion of the amount converted — generally, the whole amount minus any after-tax contributions. Under current law, the Roth account would incur no further income tax liability, regardless of how much growth the account experiences.

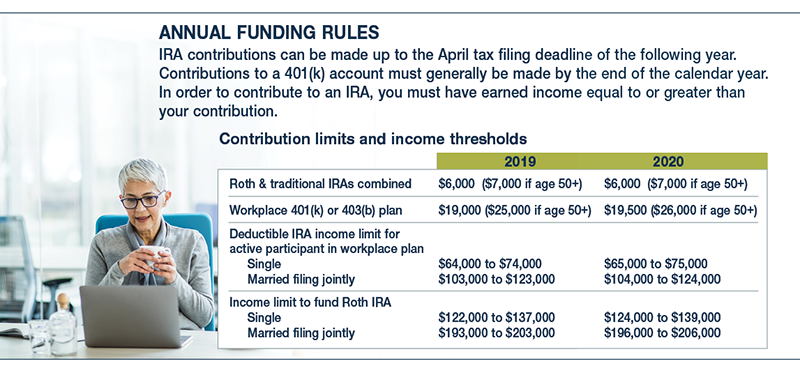

You can contribute to traditional and/or Roth IRAs and employer-sponsored plans in the same tax year, up to annual contribution limits, as long as you meet other requirements (see chart). You can generally move funds without tax consequences from a traditional employer plan to a traditional IRA, or from a designated Roth employer account to a Roth IRA. If you want to move funds from a traditional IRA or employer plan to a Roth IRA, the transfer is considered a taxable conversion.

Distributions from traditional IRAs and employer plans, and the earnings portion of nonqualified distributions from Roth IRAs and workplace accounts, are taxed as ordinary income. Withdrawals prior to age 59½ may be subject to a 10% federal income tax penalty, with some exceptions.* To qualify for the tax-free and penalty-free withdrawal of earnings, a Roth IRA must meet the appropriate five-year holding requirement, and the distribution must take place after age 59½, unless another exception applies.

*The Coronavirus Aid, Relief, and Economic Security (CARES) Act suspended RMDs for 2020 and waived the 10% early-distribution penalty for coronavirus-related retirement plan distributions up to $100,000 in 2020.

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2020 Broadridge Investor Communication Solutions, Inc.

Ready to Take The Next Step?

For more information about any of our products and services, schedule a meeting today.