What Is Cyber Insurance, and Do You Need It?

Does your company store or communicate potentially sensitive information about customers, employees, or competitors? Cyber attacks and loss of data can be devastating to a business, so you may want to be proactive about addressing this risk.

Start by determining areas of vulnerability. Then create cybersecurity policies and procedures for employees to follow.

You might also consider purchasing cyber insurance, which provides protection against potential financial losses resulting from data breaches caused by cyber attacks, viruses, and other threats. It also helps cover third-party lawsuits filed against your company resulting from data breaches or your failure to adequately protect sensitive or confidential information.

Who Needs Cyber Insurance?

Your company or organization may be a candidate for cyber insurance if it does any of the following:

- Sends or receives documents electronically

- Communicates with customers or other outside parties via email, text messages, or social media

- Stores third-party information on a computer network that may be considered sensitive or private, such as an individual’s identity, tax information, income, address, Social Security and/or credit-card numbers

- Stores confidential company information (e.g., tax documents, sales or marketing figures or projections, trade secrets) on a computer network

- Advertises company services or products via a website or social media

What Does It Cover?

While individual policies may differ, cyber insurance can help cover:

Loss of data. Cyber insurance may help cover the cost of restoring or reconstructing data that was lost, stolen, or damaged.

Losses from data breach or security failure. Cyber insurance may cover some of the costs of investigating how and where the breach occurred; expenses associated with regulatory fines; legal costs of defending against lawsuits and settlement of claims brought by victims whose information was inappropriately accessed, shared, or lost; expenses related to notifying victims of the data breach, such as customers and employees.

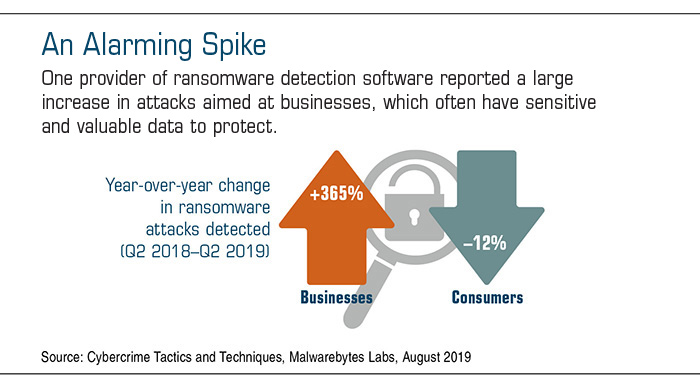

Costs associated with extortion or ransom demands. That’s right, a cyber criminal may demand a ransom or try to extort money from your company in exchange for your data. Cyber insurance covers some costs of paying the ransom for the data or for the restitution to victims whose information was captured.

Losses from business interruption. If your company must close while the data breach is investigated and resolved, cyber insurance can help offset the ordinary costs and expenses of your business during its down time.

The cost of cyber insurance depends on the types of coverage selected, and policies have exclusions, terms, and conditions for keeping them in force.

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2020 Broadridge Investor Communication Solutions, Inc.share|

Ready to Take The Next Step?

For more information about any of our products and services, schedule a meeting today.