Give and Receive with a Charitable Remainder Trust

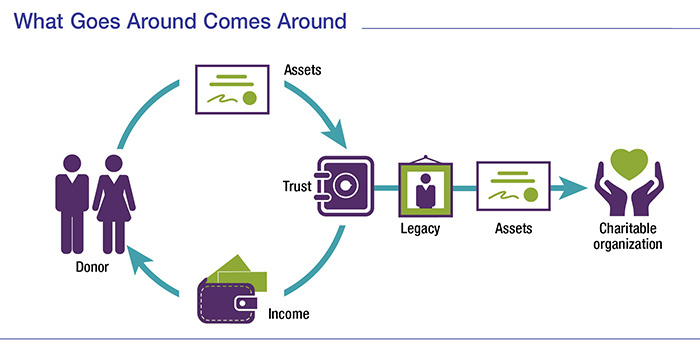

Scientific research suggests it really is better to give than to receive — that spending money for the benefit of others may lead to longer-lasting happiness than spending money on yourself.1 However, by structuring a donation using a charitable remainder trust (CRT), you might have the best of both worlds: a substantial gift to your favorite charity and a flow of income during your lifetime.

To understand the potential benefits of a CRT, consider what would typically occur if you sold assets, such as securities or property, in order to give the proceeds to a charitable organization. In most cases, you would incur capital gains taxes on any appreciation in asset value, which would reduce the value of your charitable contribution (if you paid the taxes out of the proceeds) or require an out-of-pocket expenditure. Although you might receive an income tax deduction in the year of your donation, you would receive no further financial benefit from the contribution.

A Strategic Approach

With a CRT, you donate by first placing the assets in the trust. In addition to naming the charitable organization as the first beneficiary, you can designate an income beneficiary — yourself or anyone else you choose — to receive specified payments from the trust for a set term of up to 20 years or for your lifetime (or the lifetime of your surviving spouse or designated beneficiary). Income payments must be made at least once a year and may be fixed or variable depending on the type of CRT you use. Upon your death (or the death of your surviving spouse or designated beneficiary), the assets in the trust go to the charity.

After the assets are transferred to the charitable trust, the trustee may sell them and reinvest the proceeds in income-producing assets without incurring capital gains taxes. This maintains the full asset value to fund your specified income and could increase the ultimate value of the gift to the charity.

Although the annual trust income is usually taxable, you may qualify for an income tax deduction based on the estimated present value of the remainder interest that will eventually go to the charity.

Types of CRTs

A CRT can be an inter vivos (living) trust funded during your lifetime or a testamentary trust funded at your death for the benefit of your heirs. In either case, there are two basic types of CRTs, with significant differences in the payment structure.

A charitable remainder annuity trust (CRAT) pays a fixed percentage of the trust’s initial value to the donor (or selected beneficiary) each year. A charitable remainder unitrust (CRUT) pays a set percentage of the trust’s annual fair market value to the donor (or selected beneficiary) as income each year. The appropriate structure depends on your personal preference and situation, including your age, risk tolerance, and income needs, as well as the type of asset.

A Win-Win Proposition

A CRT could be a win-win proposition for you and your favorite charity. However, it’s important to remember that a CRT is an irrevocable trust. Once you’ve made your decision, you cannot change your mind.

While trusts offer numerous advantages, they incur up-front costs and often have ongoing administrative fees. The use of trusts involves a complex web of tax rules and regulations. You should consider the counsel of experienced estate planning, legal, and tax professionals before implementing such strategies.

1) Psychological Science, December 27, 2018

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2020 Broadridge Investor Communication Solutions, Inc.

Ready to Take The Next Step?

For more information about any of our products and services, schedule a meeting today.