Qualified Charitable Distributions

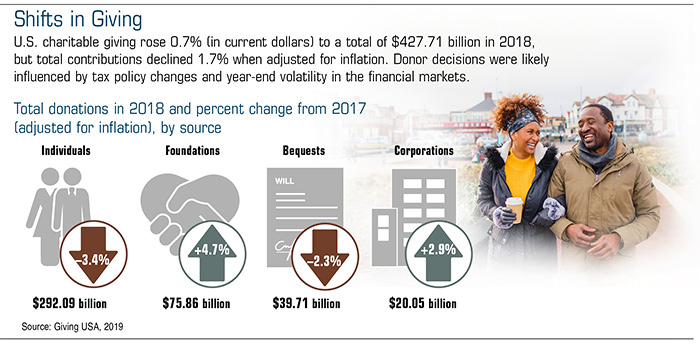

The Tax Cuts and Jobs Act roughly doubled the standard deduction and indexed it for inflation through 2025. (The standard deduction is $12,200 for single filers and $24,400 for married taxpayers filing jointly in 2019; in 2020 it rises to $12,400 and $24,800, respectively.) As a result, far fewer taxpayers will itemize deductions on their tax returns, and some people may be disappointed that they no longer benefit from writing off their charitable donations.

If you are 70½ or older, you can use a qualified charitable distribution (QCD) to donate from your IRA and get a tax break, whether you itemize or not. This is the same starting age for taking annual required minimum distributions (RMDs) from traditional IRAs, which are normally taxed as ordinary income, or face a 50% penalty on the amount that should have been withdrawn. (The SECURE Act increased the RMD start age to 72 for account holders who reach age 70½ after December 31, 2019.)

QCDs satisfy all or part of any RMDs that you would otherwise have to take from your IRA. Better yet, QCDs are excluded from your income, so they help lower your adjusted gross income (AGI) as well.

How QCDs Work

The IRA custodian must issue a check made out to a qualified public charity (not a private foundation, donor-advised fund, or supporting organization). In some cases, the IRA custodian may provide a checkbook with which you can write checks to chosen charities. Be aware that any check you write will count as a QCD for the year in which it is cashed by the charity, whereas a check from the custodian counts for the year in which it is issued.

You must wait until after you are 70½ to make a QCD. The QCD exclusion is limited to $100,000 per year. If you’re married, your spouse can also contribute up to $100,000 from his or her own IRA. You cannot deduct a QCD as a charitable contribution on your federal income tax return — that would be double-dipping.

A QCD must be an otherwise taxable distribution from your IRA. If you’ve made nondeductible contributions, then each distribution normally carries with it a pro-rata amount of taxable and nontaxable dollars. With QCDs, the pro-rata rule is ignored, and taxable dollars are treated as distributed first.

Perks for Itemizers

If you no longer itemize, you could reduce your tax bill by donating with QCDs from your IRA instead of writing checks from your standard checking account. And if you still itemize, QCDs might prove more valuable than tax deductions. That’s because they can help address tax issues that might be triggered by income from RMDs.

For example, a deduction reduces your taxable income by the amount of the charitable gift, but it does not reduce your adjusted gross income. This is a key distinction because the 3.8% tax on net investment income, Medicare premium costs, taxes on Social Security benefits, and some tax credits are based on AGI.

Also, charitable giving can typically be deducted only if it is less than 60% of your adjusted gross income. But with QCDs, you may be able to give more than 60% of your AGI and exclude the entire amount (up to the $100,000 cap) from your taxable income.

Qualified charitable distributions are available from traditional IRAs, Roth IRAs (with taxable amounts), and inactive SIMPLE or SEP IRAs, but they are not allowed from employer retirement plans such as 401(k)s and 403(b)s. Thus, you might consider rolling funds from an employer plan to an IRA if you want to take advantage of a giving strategy that involves QCDs.

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2019 Broadridge Investor Communication Solutions, Inc.

Ready to Take The Next Step?

For more information about any of our products and services, schedule a meeting today.